Capital One has released a survey of 151 fintech and payments innovators which they conduced at Money 20/20 a couple of weeks ago.

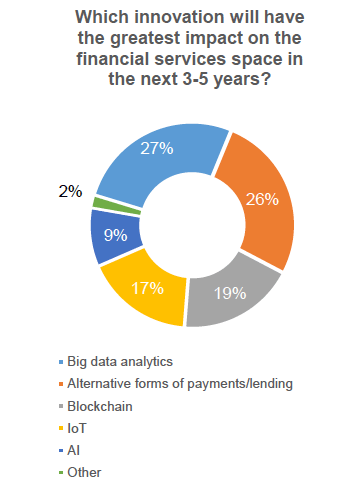

Given this non-random sample of participants, it is probably not surprising that Big Data Analytics and Alternative Payments Platforms were the top two answers (at 27% and 26%, respectively) to the question “Which technology innovation will most impact financial services in the next 3-5 years?”.

The only surprising to me about the number three answer was how “blockchain”, only came in with 19% of the vote. It’s been at the top of the hype curve over the last few months, as I reported from Sibos.

The survey also asked for some predictions about finance in the year 2030.

At the top of this list was the prediction that the majority of payments in 2030 will be cashless, non-paper based (56% of respondents), and that Social media shopping will account for nearly half of holiday sales transactions by 2020 (22%).

If these predictions are accurate the customer experience gap that banks have with their customers today is only going to get wider. Sounds like a good time to get to work on innovating some new products and new customer experiences.

The survey also has questions on the future of data security and fraud prevention.

Here’s a short video with highlights from the survey results from Capital One, which partnered with me to provide data for this post:

Join the discussion on Twitter with @CapitalOneLabs and with the hashtag #BankOnTech. More information is available at press.capitalone.com.

They both suggest kind of a Strengths Based Leadership approach for companies– improve your weaknesses enough to prevent failure, but the focus on your strengths to achieve greatness.

They both suggest kind of a Strengths Based Leadership approach for companies– improve your weaknesses enough to prevent failure, but the focus on your strengths to achieve greatness.